The Buzz on Hsmb Advisory Llc

An asset has three crucial characteristics: It symbolizes a possible future advantage that includes a capacity, singly or in mix with other properties, to contribute straight or indirectly to future net cash money inflows; A particular entity can obtain the benefit and control others' accessibility to it; and The deal or various other event-giving increase to the entity's right to or control of the advantage has actually already happened.

- A governmental pool established to write service declined by carriers in the standard insurance market. - a policy or cyclist that gives coverage just while an insurance policy holder is constrained to a nursing home and meets the plan requirements for coverage. - the presumption of threat from another insurance entity within a reinsurance contract or treaty.

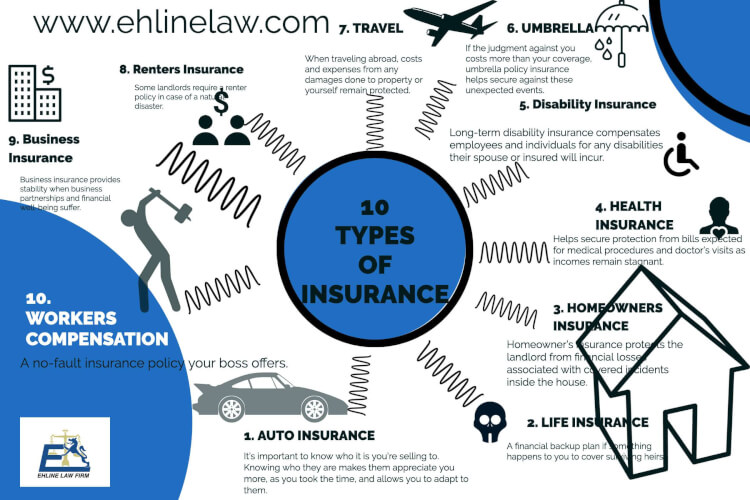

- academic quantity of funding plus excess an insurance policy firm must preserve. - reinsurance positioned with a reinsurer that is accredited or otherwise allowed to perform reinsurance within a state. - protection that shields against economic loss since of lawful liability for automobile relevant injuries (bodily injury and clinical settlements) or damages to the residential property of others brought on by mishaps arising out of ownership, maintenance or use a motor automobile (including leisure automobiles such as electric motor homes).

Getting The Hsmb Advisory Llc To Work

No Fault is defined by the state worried. - automobile insurance protection (consisting of crash, vandalism, fire and theft) that insures against product damage to the insured's automobile. Health Insurance. Commercial is defined as all electric motor car plans that consist of lorries that are utilized about service, business facilities, activity, work, or tasks lugged on for gain or revenue

- accountancy statement revealing the economic problem of a business at a particular day. - category system for assessment of building ordinance per geographical region with special focus on mitigation of losses from natural disasters. - an individual that may become qualified to get payment due to will, life insurance policy plan, retirement, annuity, trust fund, or other agreement.

- insurance coverage for residential or commercial property and responsibility that reaches greater than one area, class of building or staff member. - covers damages to pleasure watercrafts, motors, trailers, boating devices and personal boat in addition to physical injury and home damage responsibility to others. - physical injury including health issues or illness to an individual.

The 9-Second Trick For Hsmb Advisory Llc

Benefits consist of (i) residential or commercial property of the insured, which has actually been straight harmed by the mishap; (ii) costs of short-lived repairs and quickening expenditures; and (iii) obligation for damages to the home of others. Insurance coverage additionally consists of evaluation of the equipment. - a form of debt security whereby the financial debt owner has a lender risk in the business.

- initial expense, consisting of capitalized acquisition expenses and built up devaluation, unamortized costs and discount rate, deferred origination and commitment fees, straight write-downs, and increase/decrease by modification. - an individual who gets payments from the sale and solution of insurance plan. These individuals function on part of the consumer and are not limited to selling policies for a particular business however compensations are paid by the company with which the sale was made.

Indicators on Hsmb Advisory Llc You Should Know

- loss of income as a result of property damage to an organization facility. - business insurance coverage commonly for property, obligation and service disruption protection. - in medical insurance, the amount that needs to be paid by the insured throughout a calendar year before the insurance firm comes to be in charge of further loss expenses.

- legal requirement getting firms to keep their capital and excess at a quantity equivalent to or over of a specified quantity to assist assure the solvency of the business by providing an economic cushion versus anticipated loss or slipups and typically measured as a company's admitted assets minus its liabilities, established on a statutory audit basis.

Relied on the basis of original price readjusted, as suitable, for amassing of discount or amortization of premium and for depreciation (https://profile.hatena.ne.jp/hsmbadvisory/). - a settlement plan used in connection with some taken care of treatment agreements where a physician or various other clinical carrier is paid a flat quantity, generally on a regular monthly basis, for every subscriber that has chosen to use that doctor or clinical carrier

The capitated service provider is generally liable, under the problems of the contract, websites for providing or preparing for the distribution of all got health and wellness solutions needed by the covered individual. - a person that sells or solutions insurance contracts for a specific insurance firm or fleet of insurance companies. - an insurance policy firm developed by a moms and dad company for the objective of guaranteeing the moms and dad's exposures.

The 6-Second Trick For Hsmb Advisory Llc

- a circulating medium. - short-term, highly fluid investments that are both (a) readily exchangeable to recognized amounts of cash money, and (b) so near their maturation that they provide trivial danger of adjustments in worth as a result of changes in rates of interest. Investments with original maturities of three months or less qualify under this definition.